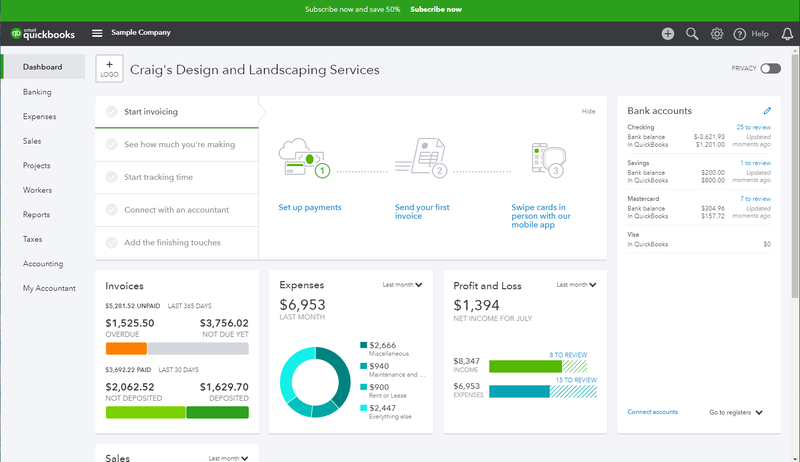

Moreover, many online accounting tools have options to create useful online reports on taxes. Some accounting software helps prepare your taxes, or if your law firm hires an accountant to prepare your taxes, legal accounting software helps keep accurate records that are essential at tax time. Legal accounting software assists with taxes in multiple ways. In that case, you can also generate pay runs with the click of a button, for better efficiency. Suppose you choose accounting software that automatically syncs payroll functionality with time-tracking and expense apps. Online legal accounting software helps by automating your payroll. No matter how big or small your law firm is, accurate, timely payroll is essential-but it can be time-consuming to complete manually. Online payment solutions like Clio Payments also streamlines your collections and accounting workflows.

This data shows that clients find software that securely accepts online credit card payments is more convenient. Online PaymentsĪs the 2021 Legal Trends Report found, the majority (66%) of consumers expect to pay for legal services online. Take Xero and Clio Manage, the integration lets your firm automatically connect your client invoices and expenses from your practice management software to your accounting software-streamlining the process. Legal accounting software with billing features (such as the ability to create or track invoices) or that connects with your practice management software helps simplify your workflows. Tools like Clio’s legal trust and accounting software features help you create trust and operating accounts as required by legal industry regulators, generate invoices that comply with regulations, run reports required for trust accounting compliance, and easily reconcile accounts. Trust accounting must be done correctly in order for law firms to stay compliant. Lawyers can benefit from effective and easy-to-use time-tracking features-like multiple time-tracking capabilities from QuickBooks with Clio Manage. Time trackingĬapturing every minute of billable work is critical for accurate law firm billing and, ultimately, profitability. Legal accounting software that syncs your firm’s financial activity (the Clio and Xero integration, for example, lets you automatically connect client invoices and expenses from Clio with Xero) helps take care of bookkeeping tasks automatically-creating more accurate records with less work for you. It’s essential that your firm’s bookkeeping of financial transactions and accounts be meticulous and accurate. Not sure what you should be looking for if you’re conducting a legal accounting software comparison? Consider the following key law firm accounting software features: Bookkeeping From understanding what software benefits your law firm to choosing the best legal accounting software for law firms, read on to learn more about your options. With that said, it’s not always a simple or easy decision to choose new technology for your practice.

While on-premise accounting software ties you to a physical location and requires high maintenance costs and time-consuming updates, cloud-based accounting software is accessible anywhere.Ĭloud-based accounting software for law firms also automatically gets updated and backed up and offers unparalleled, real-time insights into your law firm’s financial data. The advantages of legal accounting software multiply with today’s cloud-based solutions. Legal accounting software simplifies your firm’s accounting and bookkeeping workflows-making it easier to stay compliant with ethics rules, protect sensitive client information, and effectively monitor your day-to-day cash flow. Keeping accurate records of your law firm’s accounts is a challenging yet vital part of running a legal practice.

0 kommentar(er)

0 kommentar(er)